Sold half of the holdings on sell signal at 0.405 on market.

Queue (limit order) at 0.41. Yesterday close at 0.40 (stop loss point).

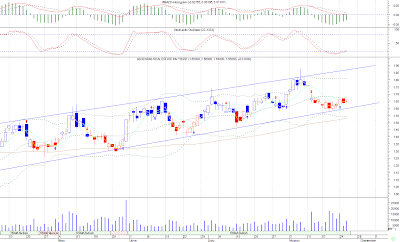

My RSMA expert showed sell signal. Also, last few trading session indicates moving away from upper line of Bollinger Band.

Decided to sell all later because the counter is extremely quite and all the transactions are extremely small. No big player in sight. Only small players playing with small lots of 1 lot to 10 lots.

In summary: Golden Agri Resource -> Good trade with 16.6% net gain (after all transaction fees) in 2 weeks.

Overall market seems to be soften for now. There could be some corrections coming soon. Whatever it is, I will still wait for the signals from the system.

Current holdings:

Cosco: bought at 1.32.

Sembmar: bought at 2.85

Olam: bought at 2.48

UOL: bought at 3.53

Sold Olam later at 2.51. This counter has not been showing a lot of strength. The overall market looks weak. There is a bid sell down today for no aparent reason. This might signal further weakness or correction. Overall market is over bought. Market is waiting for more data to be released. Decided to take a cautious approach.

On the hindsight, the selling of Golden Agri seemed unwarranted because it bounced up 0.02 to close at 0.425. That is almost 5% higher from the sold price. This indicates that the system is too aggressive in issuing signals. Another parameter is needed to control the signal or making decision. More research into this area is needed. Some solutions are:

The use of N maybe needed. For example, setting the stop at 2N to take higher risk?

The used support line?

Use of other indicators like RMO, Bollinger Bands?

Anyway, it is still too early to tell if the price of GoldenAgri will sustain. Let's see how it will move from here.

One of the big fear has been prices plunging through the cut loss point dramatically. This could result in taking too much risk and potentially losing everything in a short. The market is now very volatile and changes are fast and sometimes furious.